Massachusetts employers offer health insurance 15% more than national average, CHIA report says

DATE: June 9, 2022

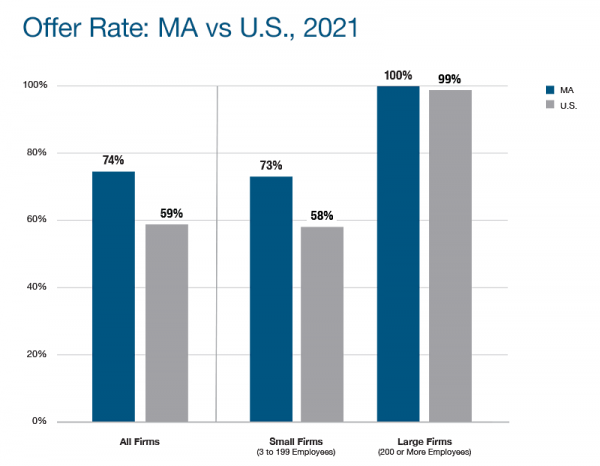

Nearly three-quarters of Massachusetts companies offered health insurance to their employees at the start of 2022, which was 15% more than the national rate of 59%, according to a new state report from the Center for Health Information and Analysis (CHIA).

“Employer-sponsored insurance is the most common avenue for residents to obtain health insurance coverage in Massachusetts,” Ray Campbell, CHIA’s executive director, said in a press release. “This survey provides valuable data on the changes and trends in the employer-sponsored health insurance market, in addition to key insights on how the pandemic affected workplace health benefits in the Commonwealth.”

The Massachusetts Employer Survey (MES) tracks employer health insurance offerings, employee take-up rates, health insurance premiums, employer contribution amounts, plan characteristics and employer decision making, according to the agency. CHIA added that employer-sponsored insurance shapes the state’s insurance markets, impacting the demand for public insurance programs like MassHealth.

The Massachusetts Employer Survey, which was conducted from May 2021 to January 2022, also found:

- The monthly premium for single coverage was $715 in Massachusetts, $70 higher than the national average;

- Massachusetts employers contributed an average of 25% to the premium for single coverage, compared to the rates of national employers at 17%; and

- For families, average monthly premiums ranged from $1,397 when covering only child dependent(s) to $1,956 for coverage that includes spouses and children. On average, employees contributed 27-29% to family coverage premiums.

Additionally, the survey reported that nearly half of employees were enrolled in high deductible health plans (46%), and 33% were enrolled in a HDHP with a savings option. Most Massachusetts employees, however, were enrolled in preferred provider organizations and health maintenance organizations plans.

Depending on where you work, your coverage could look different. All large employers, which have over 200 employees, offered insurance. However, 73% of small employers, which have 3-199 employees, did not offer insurance.

The most common reason employers said they offered health insurance was because, “it is the right thing to do,” CHIA's report said. The most common reason employers didn’t offer health insurance was because “employees are covered under another plan.”

Most Massachusetts firms, 74% offered health insurance to their employees in 2021, a higher rate than firms nationally at 59% - CHIA

As far as how firms choose plans, Massachusetts employers said that the cost of the plan (91%), the services covered (62%) and the provider network (55%) were the most common deciders.

Insurance coverage is also evolving to keep up with current issues, as firms have expanded access to telehealth, waived or reduced cost-sharing for Covid-19 treatment and expanded access to behavioral health services since 2020, according to CHIA.

However, during the difficulties caused the pandemic, 16% of all Massachusetts employers increased member cost-sharing to control costs, the report said. More cost controlling strategies include changing carriers or plans (12%), offering wellness programs or incentives (6%) or offering a HDHP (10%).

Article by Cassie McGrath – Reporter, Boston Business Journal, Thursday, June 9, 2022